Hi! I'm Max.

In just 5 years, I've taken in over $80,000 in rental income and saved $100,000 at age 27.

I will help you get clarity on how to rent your spare bedroom and put a system in place that makes you money every month.

Are you ready for someone else to pay your mortgage & use that money for your next vacation to The Bahamas?

Get access to my free step-by-step guide now.

As Seen On

Latest Posts

-

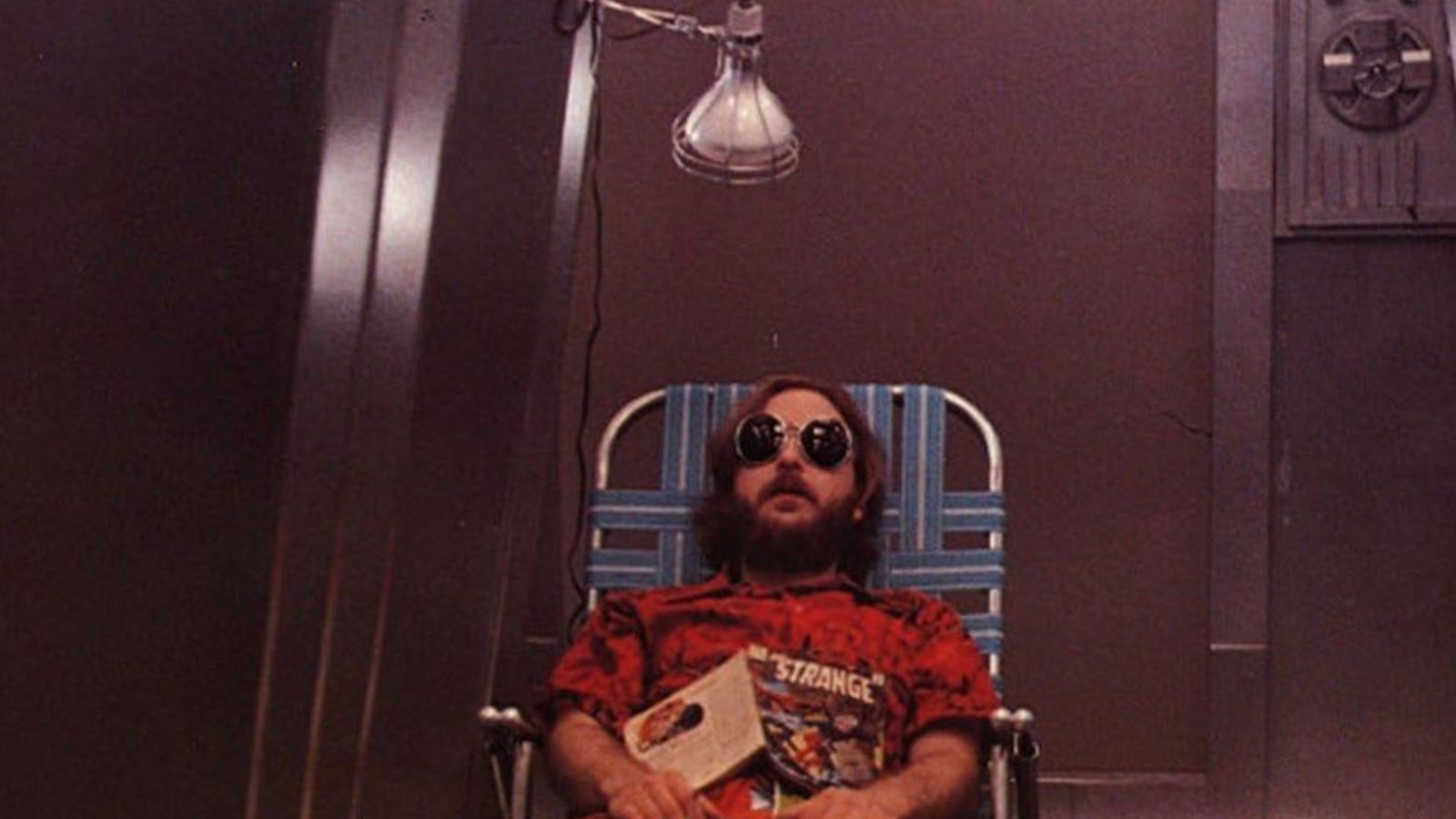

10 Movie Remakes That Could Be Disastrous (But We're Watching Anyway)

-

Survival Basics: 10 Items to Help You Stay Safe

-

Hidden Sci-Fi Treasures: 10 Must-Watch Overlooked Gems

-

20 Partners Share Stories of Uncovering Shocking Truths Later in Their Relationships

-

Cooking Wisdom: 10 Expert Tips Shared by Chefs

-

Lights, Camera, Cameo: 10 Unforgettable Movie Appearances

-

10 Hygiene Habits You Need to Stop Skipping

-

The Last Straw: 20 Tales of Relationship Endings Over Small, But Significant Issues

-

Freelancer Money Troubles: 10 Big Issues and How to Solve Them

How I make $11,000 per year renting out my spare rooms?

Get access to my FREE guide now.