A Reddit user shared his story of wanting his wife to give up two months of her “fun money” to pay off tax debt.

Monthly Allowance

The original poster (OP) explained that he does the finances for the house. He said they each get an “allowance” every time he is paid since he makes twice as much money as she does. They split the allowance total in half so they each get some semi-monthly. Her income goes towards the bills.

They recently found out that they owe a few thousand dollars in taxes. He got into an argument with her that if they just didn't give themselves an allowance for two months and used some of their savings, they would be able to pay off that debt. She was strongly against losing her fun money, but OP told her that it was just for a couple of months and she said she didn't care.

OP said that he would be willing to do it completely with his half of the money. She said no she needed at least a little so they compromised and she gets around 1/4 of her usual amount to put towards makeup and skincare. OP said he felt very annoyed that she wasn't willing to sacrifice two months to pay off their tax debt.

He said it's not like it's some stupid debt he racked up on his own and is expecting her to contribute to. It's both of their debts.

Related: 10 Things That Men Don't Realize Makes Them Insanely Attractive

The Masses Weigh In

The Reddit community wasn't so sympathetic to OP's situation.

One user said, “Why not leave her enough fun money to cover her skincare and take a little longer to pay it off? Tbh, I’m kind of uncomfortable with needed personal care stuff coming out of “fun money”. My husband and I both get our personal care products as part of the household budget, and fun money is for unnecessary things.”

Another user chimed in, “Firstly, if you are the financially savvy one, you should've either planned better for your tax bill or hired an accountant so you knew how much you should put aside. Secondly, you can take more time to pay it off, or save less/invest less and take some, but not all of the fun budget instead of all. Thirdly, as mentioned a lot, skincare and makup shouldn't be fun money, that's a necessary spend.”

Related: 10 Things Women Say Men Need To Stop Doing Immediately

Another user tried to put things in perspective:

“Wife doesn’t pay all the bills. They pool all their money, pay their expenses and they both have the exact same amount of fun money. What OP is suggesting is paying the taxes with THEIR fun money for two months. So if the both get $200 the total tax bill $1,600. The goal is to have it paid before 4/15 otherwise fees and penalties start accruing. If they stretch it out to three months then they pay the original tax debt plus a month of penalties which can be 2% compounded daily which changes every day. So OP wanting to pay it off before the deadline is the best thing to do to avoid paying more.

Ready to make your first budget?

Enter your email and get the free template

The other option is to make sure both of them check their tax withholding (w-4) and make sure they have it correct. Sometimes people follow the government guidelines and claim the number the worksheet tells them. This is never to your benefit in the long term. This is designed to give you more money in your paycheck but when tax time comes you’ll owe much more than before.

For example the IRS suggests you always claim yourself, 65+, blind, all children, any qualified adults who may not be related but live in your home that you care for. So assuming your 25, married with 1 child the IRS expects each you to claim at least 1 then the child. So who ever makes the most would claim 2 and the other just one. While this is great in theory you pay less in taxes.

To avoid paying at the end of the year never claim yourself only the child on one and nothing on the other. If you have no children claim “ZERO”. This still won’t guarantee you won’t pay at the end but you’ll pay less. I have no children claim zero and still had to pay this year. I adjusted my withholding to pull a little extra out each paycheck so I don’t have to pay next year.”

Should OP's wife get to keep her allowance? Should she sacrifice for two months to help pay off the tax debt? How would you have reacted in this situation?

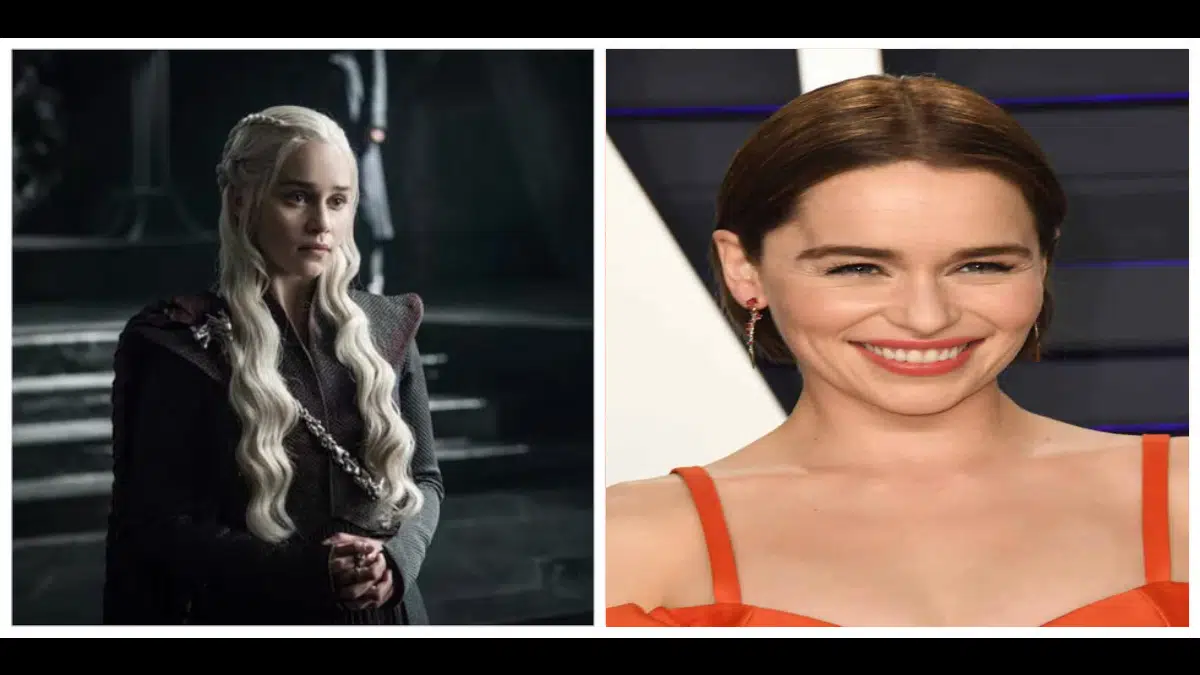

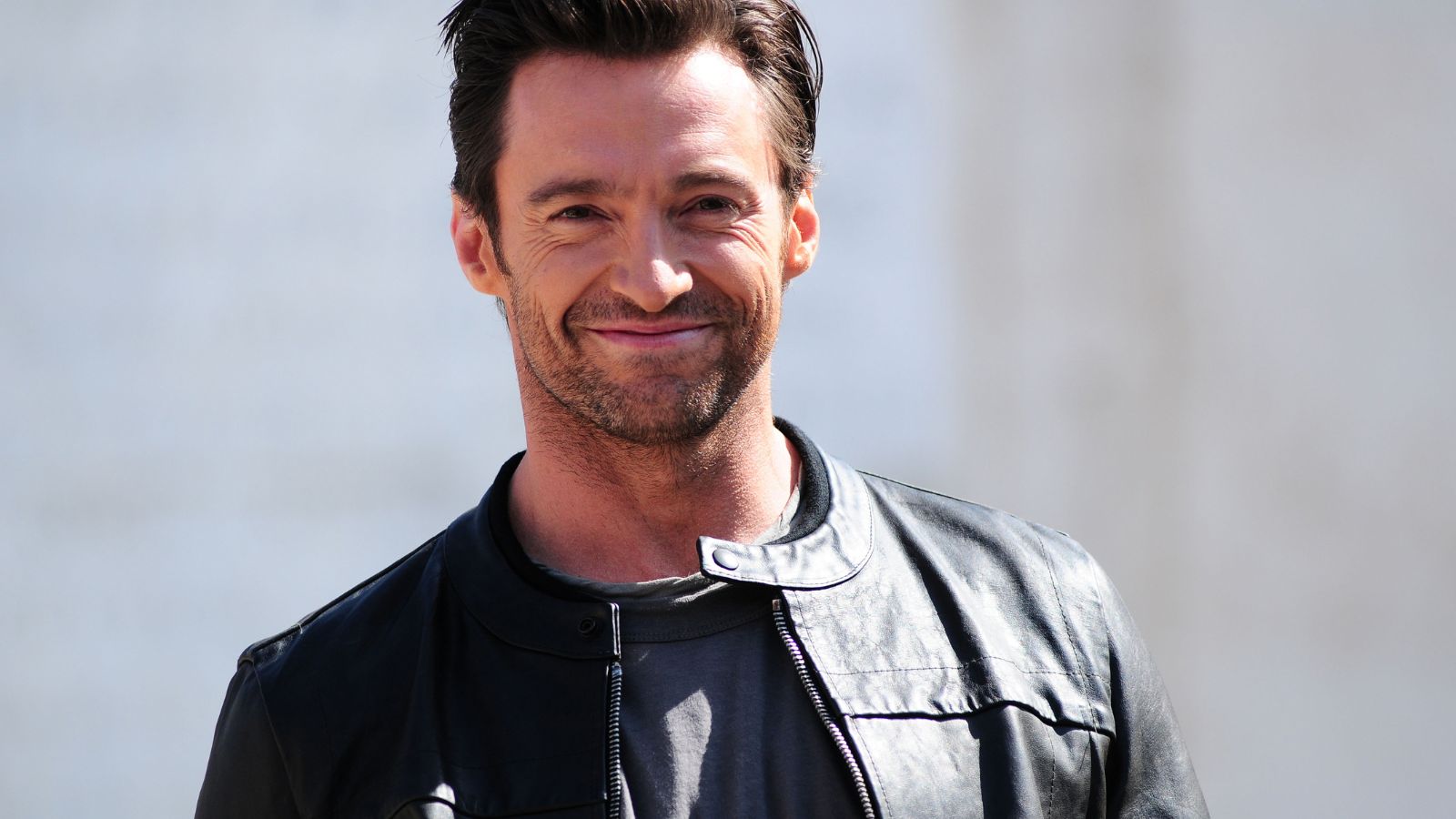

30 Stars Who Look Nothing Like Their Characters

We've all seen it before. An actor who looks nothing like their character on the big screen. We've all seen it before. It can be pretty jarring and often leaves us wondering how they even got the part in the first place. In this article, we will look at 30 actors who don't look anything like their characters! Some of them are so different that you might not even recognize them!

How I make $11,000 per year renting out my spare rooms?

Get access to my FREE guide now.

10 Surprising Movie Characters That Could Never Be Replaced With a New Actor

Sometimes a show or movie is different with the actors playing the characters. Would we love their characters as much if they were played by someone else? See who people claim could never be replaced in their iconic roles with another.

10 Terrible Movies People Love, But Admit Are Horrible

Movies are subjective, and what one person considers a cinematic masterpiece, another may view as a cringe-worthy disaster. However, some films have gained a reputation for being particularly terrible yet still manage to capture the hearts of audiences. These are the guilty pleasure movies that people love to hate but can't help but watch again and again.

10 Terrible Movies People Sat Through Hoping They Would Get Better, But Never Did

Have you ever watched a movie hoping it would get better, but it only got worse? It can be a disappointing and frustrating experience, especially if you were really excited to see the movie in the first place. Let's see the movies that disappointed viewers and wonder why they didn't just leave the theater or turn off the TV.

10 Terrible Things That Automatically Ruin Good Movies

Lights, camera, action! Movies are the ultimate adventure, taking us on a journey to fantastical lands, introducing us to characters out of this world, and stirring emotions within us. However, not all movies are created equal, and certain things can instantly ruin a movie for some viewers. Recently, in a platform discussion, people shared several things that can automatically ruin movies.

Read the original post here.

This article was produced and syndicated by Max My Money.

How I make $11,000 per year renting out my spare rooms?

Get access to my FREE guide now.