Depending on who you ask, investing in the stock market can be a rewarding, exhilarating experience or a fruitless, disappointing one. It takes a keen eye and exceptional analytical skills to be able to predict the rise and fall of stocks. Most of those people are obviously professionals and have made a career out of it.

But for people who just want to invest a little and see if their money will grow, the stock market is a high risk high reward venture.

Let's go through some pros and cons of investing in stocks.

Pros of Investing in Stocks

Stocks grow with the economy, usually

As the economy grows (GDP), so do corporate earnings. This is because economic growth creates jobs, which in turn creates income, which then generates consumption from the consumer (you and me).

Simply put, in a “normal” economy as the gross domestic product (GDP) increases so should the underlying US stock markets.

Things start to go wonky with stock buyback programs. This is when companies, with a combination of debt and cash buy some of their own shares.

Why would a company do this?

Because the more “demand” there is for a stock the higher that stock price goes. The company can push its stock higher than normal due to the artificial demand they create by buying back its own shares. This creates an “abnormal” economy where the stock market appears to be doing very well while the normal economy is not doing well.

A 2019 CNBC article reporting on company buyback programs had this to say:

- Share buybacks are expected to approach $1 trillion this year, according to Goldman Sachs

- Funding is coming from a record drawdown in cash as well as a rise in gross debt and leverage

- Buybacks have exceeded free cash flow for the first time since the financial crisis

When doing research on any stock make sure to look up whether a company has done any recent buying of its own stock. This may indicate the stock price is higher than it should be.

Stocks help you stay ahead of inflation

Over the last century, stocks have historically had an annual return of 10%.

Inflation (or CPI) is typically 2-5%. so by holding onto your stocks for longer, you will still see a positive return, even if the value of the dollar temporarily drops.

Ready to make your first budget?

Enter your email and get the free template

Stocks are easy to purchase

One of the great things about stocks is that you have a few different options when looking to buy. You can go through a stockbroker, use a financial planner, or do your own research and purchasing online. Stocks are also favorable because they can be bought in minutes. Additionally, online services such as Robinhood allow you to purchase stocks with no commission fee.

Stocks are easy to sell

Stocks are great because they are highly liquid.

You can sell them at realistically anytime. The ability to turn shares into cash quickly can really come in handy when you're in a bind and need some cash.

Just be aware that stocks are volatile. They go up and they go down every minute of the day. There is always a risk of losing your money. This is why it's encouraged to become really educated before you put any of your hard-earned money in the stock market.

Stocks give you the ability to build Long-term wealth

Stocks have historically earned around a 10% annual return. This gives you a ton of opportunity to build wealth.

How I make $11,000 per year renting out my spare rooms?

Get access to my FREE guide now.

If you were to invest $5,000 annually (about $400 per month) over a 10 year period that would turn into around $101,000. Over a 30 year period, about $1,000,000.

If you play your cards right with stocks, you stand to build substantial wealth for yourself for the long term.

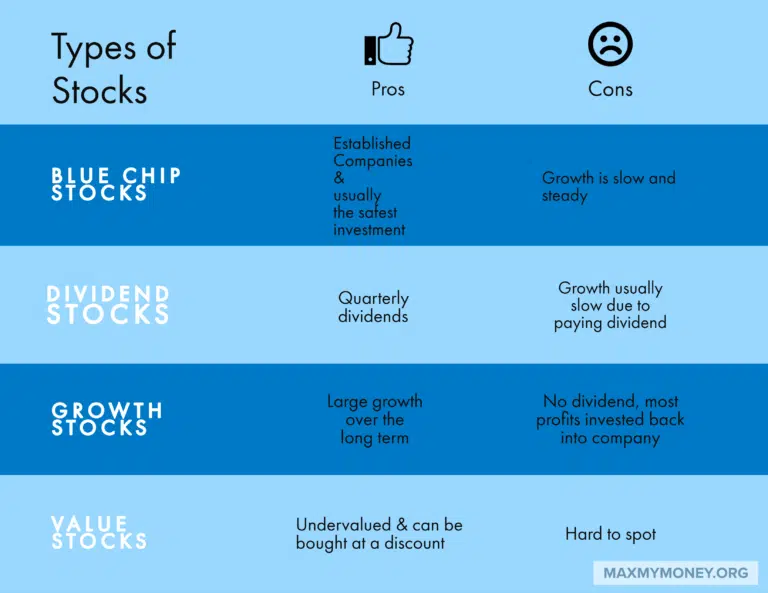

There is a stock for everyone

There are so many different kinds of stocks. You can choose to invest in start-ups or smaller businesses, or larger conglomerates that provide dividends.

With so many options, you can diversify your stock portfolio and have investments in the tech industry as well as the fashion industry. You'll never have a lack of options when it comes to choosing the right stock.

Remember to consider a stock based on the company's financials and future. With social media, it's very easy to be sucked into groupthink. Remember, just because everyone is talking about it does not mean you should buy it. A lot of times when a stock has a lot of buzz it is overpriced. Consider what Warren Buffet says about this: Be fearful when others are greedy, and greedy when others are fearful.

Cons of Investing in Stocks

Stocks are risky

Often stocks look great on the outside when you are not investing. The grass is greener on the other side they say.

You stand to lose your entire investment if the company goes bankrupt. The company's stock could drop and your investment could go from being worth $1000 to being worth $10.

On the bright side, you do get an income tax break for stock loss.

Depending on who you ask, that may just feel like putting a bandage on a bullet hole wound.

Stockholders are at the bottom of the payout chain

Preferred stockholders, bondholders, and creditors are paid first when a company goes broke.

So if you were thinking “it does not matter if your company goes bankrupt because at least I'll get paid.” Think again.

You may not see any of that initial investment depending on how many others are in line in front of you.

Stock research takes time

If you choose not to use a stockbroker or a financial planner, you will need to do your own research on all possible companies and determine which ones will be most profitable.

You will need to learn how to read and analyze companies' financial statements to determine if they are in a good place financially.

You will also need to keep up with your company on the news in case something happens that affects their stock value. It's also important to keep an eye on the market itself.

The market as a whole can fluctuate, affecting all stocks.

You Will lose money even if you know what you're doing

No one is perfect, and no one is going to pick the right stock every single time. Even if you consider yourself to be a seasoned pro at analyzing stocks, mistakes can be made.

There are situations out of your control, that's life. Just know that you will not win on every stock purchase.

How You Can Limit Your Risk by Diversifying

Diversify your investment type: Having a mix of stocks, bonds, and commodities will help to diversify your portfolio and limit risk. This can lead to a higher return over time.

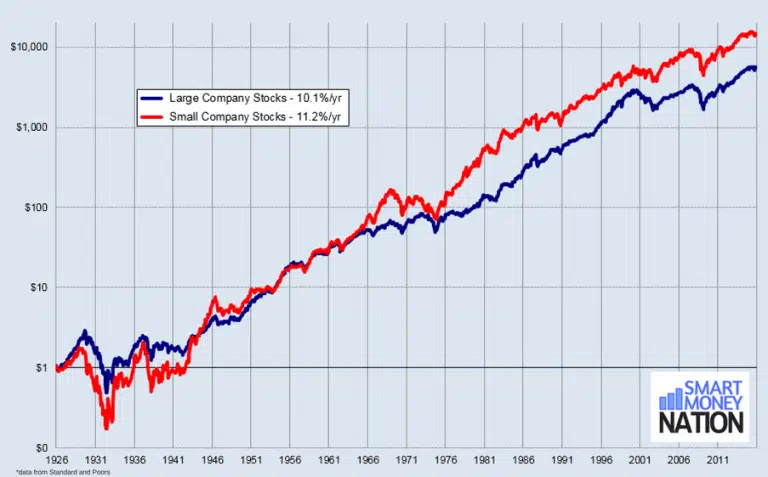

Diversify by company size: Your choices in company size are large-cap, mid-cap, and small-cap companies. Large-cap stocks are shares that trade for corporations with a market capitalization of $10 billion or more. They are the lowest risks stocks to invest in because they tend to be less volatile during tough market times. Mid-cap companies have capitalization between $2 and $10 billion, and small-cap companies have capitalization between $300 million and $2 billion. It's good to have all different sizes in your portfolio because each of these types of companies perform differently in the different phases of the business cycle.

Diversify by location: Don't limit yourself to stocks from only one location. Invest in stocks that are located in the United States, Europe, Japan, and others. By diversifying by location, you can take advantage of growth without becoming vulnerable to any one geographical location.

Diversify through mutual or index funds: When you own a mutual or index fund, you can invest in a basket of hundreds of stocks. An easy way to diversify is by using index funds or index ETFs.

Conclusion

Investing in the stock market is a high risk, high reward venture. You have the potential to build a vast amount of wealth for yourself, and on the other side of the coin, you could lose it all.

If you do your due diligence when it comes to researching stocks and learning how to read and analyze financial statements, you will likely find success. Just remember not to get too cocky. Everyone loses at one point or another. The stock market is volatile and does not favor anyone.

Make sure you have measures in place to ensure that even if you lose some or all of your investment, it will not ruin you financially.

If you are just starting with investing do yourself a favor and spend your first several months reading, listening and watching videos from experts. Investing money is not something you do without great thought. Becoming a competent investor is a journey and remember to keep learning along the way.

Stock Market Investing FAQ's

Where can I get a company's financial information?

You can access that information a few different ways. You can get it from the company's website, the stock exchange website, and through financial websites. It is best to get the information from the company's website because the reports are looked over periodically by independent auditors, so you can trust the information that you're seeing is not doctored.

How can I narrow my stock search?

Because there are so many options for stocks, you may quickly become overwhelmed. It's helpful to use a stock screener to help you narrow your search to stocks that fit your needs.

With the screener, you can apply filters such as the PE ratio, the debt to equity ratio, and the market cap. This way, you can narrow the scope of stocks to the industry you are interested in.

Should I invest in stocks when the market is high, or when the market is falling?

If the market is falling, that is the best time to buy. If there is a sale going on at your favorite store, do you make purchases, or do you wait for a potential future further markdown?

On the other hand, if the market is high, create a watchlist. If you see stocks you are interested in, don't hesitate, but make sure to avoid making lump sum investments and instead average out the stocks to avoid high priced stocks.

Are there stocks I should avoid?

Avoid stocks that have low liquidity. Stocks that have low liquidity are difficult for investors to sell and may cause you to lose some of your investment if you cannot sell the shares you want to. If there is not a market for it, there will not be buyers.

Is it more or less profitable to invest in a small cap stock vs a big cap?

Small cap companies have the potential to grow at a more accelerated rate compared to a large cap company. You may get lucky and discover a great small cap company that hasn't yet been discovered by the rest of the market. The risk is that their true potential is untested.

Large cap companies have already proved their worth. At the end of the day, the quality of stock is much more important than the size of the company.

Large cap companies are known to give good returns to shareholders, however overall it can be more profitable to invest in small cap companies if you're investing in the right stocks.

How I make $11,000 per year renting out my spare rooms?

Get access to my FREE guide now.