Many times you need debt to stay put in your life. You can get a loan to start a business, mortgage your home, and do so by taking debt. With the advancement of the banking system, debt has become quite common. The inability to pay debt makes it a wrong decision for many people. If you want to stay free of debt, you can use the following tips from experts:

1. Create a Budget

The main cause of debt is overspending on many things for many people. You can end this use by addressing the basic problem, which is overspending. To control this, you can create a budget for yourself. Creating a monthly budget for everything you buy can help you stay within spending limits.

2. Pay in Cash

Many people overspend on shopping and cross their spending limits. Due to the big limits on credit cards, they use a maximum amount of money and get into debt. The simple solution to this problem is always to keep cash in your pocket or wallet. Keeping a specific amount of money will also remind you to spend according to your budget.

3. Avoid Shopping Temptations

Many of us get a sudden urge to get up and go shopping. Many others like to scroll online marketplaces and get tempted to shop. It would be best if you put a stop to this behavior. If you don’t need anything, avoid looking at online products and stop visiting shops and malls. It will help you avoid shopping temptations and getting more debt.

4. Keep Track of Your Debt

You must keep track of your previous debt to avoid getting more debt. Keeping all the accumulated debt amounts listed in one place will help you gain insight into your total debt. Divide your income into monthly budget and debt payments. You can plan according to it, which will help you stay focused on paying the full debt amount.

5. Pay as Soon as You Can

Banks have different rules on the interest rates on debts you take. It will be wise to pay the debt as soon as you can. You must not get lazy in paying the debt, as it will double with time. Your interest rate will become higher, and it will have a negative impact on your loan terms.

6. Plan for Emergencies

To stay out of debt, you must always stay prepared for emergencies. At any time, you can get any unexpected emergency, such as an accident, car crash, or anything else. It can happen to you or your family. It will be better if you save for such unexpected incidents to help you avoid debt.

7. Negotiate Your Interest Rates

The interest rates on the loans you take are different in each bank. This is a negotiable thing. You must ask your bank to lower your interest rate. With higher interest rates, you will pay a huge amount of money. It can be one-third or two times more than the real amount of debt. If you don’t like the interest rates, you can negotiate with many other banks and find what suits you best.

8. Increase Your Income

When people get into debt, they try to pay it from their monthly income. They need to understand that it may not help them to pay back the loan timely. They can pay it in time if they try to increase their monthly income. They can start any side hustle apart from daily work to earn a bit more and pay the debt.

9. Transfer Your Balance New Account

You can transfer your balance from one account to a new one, which can help you transfer your debt to the new account. But this can only be beneficial if the new account lowers your interest rate. A lower interest rate will help you pay off the debt easily and quickly.

10. Consolidation Debt

Many banks provide consolidation debt plans for people who have high debt in their names. Through consolidation debt, all your debts will be combined into one place for your convenience. The new debt will be taken to pay them off, and you can pay off this single consolidation debt with a lower interest rate. It can help people with easy installments and lower interest rates.

“She Supports Donald Trump?” 10 Surprising Stars Who Support The Former President

There are many stars who support the former president that will surprise you.

Ready to make your first budget?

Enter your email and get the free template

These 10 Celebrity “Real” Names Are Very Different Than Their “Stage” Names

Many celebrities take on stage names to either protect their identity, or to reinvent themselves into someone else. Here are 10 celebrities' stage names vs. their real names.

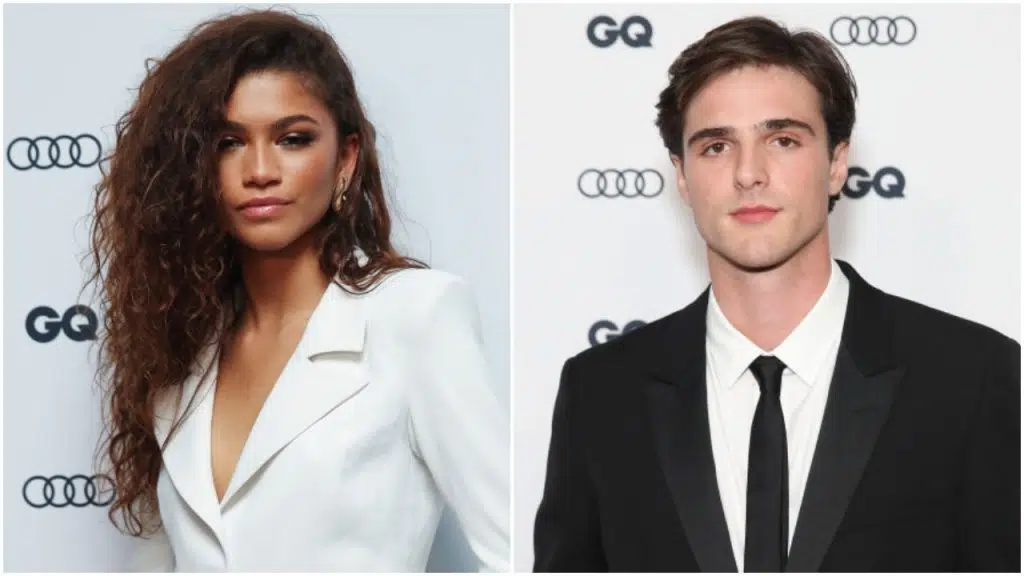

“I Hate Them Together” These 10 Surprising Celebrity Couples Made Fans Furious

Everyone has their preferences as to who their favorite celebs should have a happily ever after with. And, understandably, fans can become upset when those happily ever after dreams are crushed. Here is a list of celebrity couples that fans absolutely did not approve of.

10 Canceled TV Shows People Want To Come Back

How I make $11,000 per year renting out my spare rooms?

Get access to my FREE guide now.