Tips to Prepare for Inflation and Hyperinflation (Rising Prices)

The year 2020 showed all of us we are living in stressful and out-of-control times.

There are many possible threats to our financial system and livelihood. One of them is hyperinflation.

This article will provide you with 20 tips about how to avoid hyperinflation and thrive financially.

Tip #1: Pay off Any Debt That Has Adjustable Interest Rates

Hyperinflation will cause the value of money to decrease, meaning that it takes more and more currency units to pay off your debt.

This is because hyperinflation increases inflation rates- which are used in calculations for adjustable interest rates.

Credit card debt and other debts with adjustable interest rates are especially dangerous in a hyperinflationary environment. Imagine if the interest rates of your credit cards went from 15% APR one month and the next month the interest rate was to rise to 30% APR.

You can use inflation to your advantage by taking on loans that have a fixed rate only. This is a good hedge against out-of-control money printing by the government.

Tip #2: Think About Refinancing Your Mortgage (Look at the Consumer Price Index)

With the US federal government dependent on debt it seems unlikely the federal reserve (our central bank) will choose higher interest rates anytime soon.

If the interest rates were to rise, the economy would certainly crash. That’s bad news for everyone.

If you have a mortgage against real estate, see if you can lock in a better rate before they raise interest rates. A real estate investment can be a great hedge against inflation.

Tip #3: Attempt to Decrease Transportation Expenses

If you live in an area where you can walk, bike or carpool this can help with rising prices of transportation. Higher inflation can cause gasoline prices to increase drastically.

In California at the beginning of 2022 fuel prices were nearly $5 per gallon. As these prices rise it’s smart to find alternative ways of transportation.

Ready to make your first budget?

Enter your email and get the free template

Tip#4: Avoid Buying Things Brand New

During inflationary environments consumer prices on pretty much everything increase. Clothing, vehicles, furniture can all be bought secondhand. I have bought all three of these items used at one point or another.

Tip #5: Have a Backup Plan for All Major Appliances

If rising inflation drives up the price of electricity, it is good to have alternative methods for all of your appliances, such as hanging clothes on a clothesline or washing dishes by hand.

Inflationary times call for lifestyle changes.

Tip #6: Invest in Tangible Assets

When an economy falls into inflation and the value of currency decreases it would be prudent to consider buying silver or gold.

With gold production slowing significantly there will be less supply in the market and thus gold prices may increase.

How I make $11,000 per year renting out my spare rooms?

Get access to my FREE guide now.

The main reason I invest in hard assets like gold or silver is because I simply do not trust the government to have the citizens’ best interest at heart.

Related: 9 Reasons Why You Should Invest In Gold

Tip #7: Stock up on Food and Household Supplies

Inflation will cause the price of household supplies to increase. This will make it difficult to follow and stay within your normal budget. It’s best to trade your paper money for things that have some utility. Here’s what I’ve stocked up on:

- Protein bars

- Peanut butter

- Toothpaste

- Toilet paper

- All-purpose cleaner/cleaning supplies

- Deodorant

- Shampoo

Higher inflation erodes your purchasing power. As the prices continue to rise you will be buying the same amount of product for a much higher price. Best to be prepared with the essentials before the economy spirals out of control.

Tip #8: Eat as Many Meals at Home as Possible

Another way to save yourself during an inflationary environment is by eating as many meals at home as possible. This can be done either by purchasing food in bulk.

Even as a single person, buying a larger quantity of food that can be stored saves you quite a bit. Remember to only buy things in bulk that you can store and won’t spoil.

Tip #9: Have a Passport for Everyone in Your Family

If rising inflation becomes out of control you may consider moving elsewhere. Some even consider having more than one passport. Do your research and figure out which is best for you. Don’t rely on someone on the internet to help you make decisions.

Tip #10: Establish Sustainable Sources for Food and Water

In addition to stocking up on food and water, you should also consider how you will get these items in the future. One way to do this is by establishing sustainable sources for both food and water that won't be as susceptible to price hikes during a time of hyperinflation.

For example, you could install a rainwater harvesting system so that you have a backup source of drinking water in case the taps run dry or prices go up too high at the grocery store.

You could also start planting your own vegetables and fruits in your backyard so that you'll have access to fresh produce even if prices increase at local markets.

I have romanticized the idea of planting my own garden for years. With rising inflation, this may be the year I finally put my green thumb to good use.

Tip #11: Upgrade Your Home Security as Well as Your Personal Security

With the possibility of increased crime rates during a time of hyperinflation, it's important to take some precautions to protect yourself and your family. This includes upgrading your home security system and invoking your second amendment right.

With money chasing too few goods, prices tend to rise and that can cause some to be in a desperate situation. Again, best to be prepared for inflation on the financial and practical side.

Tip #12: Find Alternative Ways to Make Money Due to Inflation

During a period of inflation, traditional jobs may not be as lucrative or secure as you think. Even if you have a secure job you definitely need a side hustle to bring in extra income. Your monthly payments on nearly all variable expenses will increase due to inflation.

Continue reading: 50 Best Side Hustles to Make More Money

Tip #13: Diversify Your Investments

In general, with a diversified portfolio, it means that they're spread out over a variety of different types of assets. This is a good strategy for most as being too invested in a certain asset can increase your risk of loss.

There is immense value in investing in multiple sectors and investments. Inflation eats at certain investments and others not so much. Growth stocks, inflation-indexed bonds, fixed-income investments like real estate investments are all ways to diversify into different parts of the economy.

Personal finance 101 and financial experts say to most investors diversification is the way to go to beat inflation and grow your wealth.

Tip #14: Stop Saving Money and Invest It in Commodities Instead

In addition to diversifying your investments, you might also consider stopping any future savings and instead invest them in commodities or other types of raw materials that will be less susceptible to price increases. Saving money at a fixed rate is a good idea if you have a plan for the cash. There is no value during times of inflation to save money for the sake of saving. Have a plan.

Tip #15: Do Not Rely on Social Security and Medicare

The government is not going to bail you out. The cost of relying on the government during a time of high inflation is not something you want to do.

Tip #16: Be Prepared to Move

If a time where inflation becomes out of control you may find value in moving to other countries that may have a better economic future. This has happened to Venezuela most recently. It can happen to any country, even yours.

Tip #17: Cut Back on Wasteful Spending

During a time of inflation here’s the question you want to ask yourself before buying anything: is this something I need? If the answer is no, don’t buy it.

Tip #18: Become More Self Sufficient

I have learned a lot from the internet regarding pretty much everything of value. Simple house repairs, car repairs, information about inflation, stocks and mutual funds, real estate and precious metals.

As your buying power diminishes due to inflation, having a marketable skill will help you and can be used to barter for things if you can provide help to others.

Tip #19: Collect Luxury Items to Barter

There are very certain items that appreciate beating inflation. Designer bags, watches or jewelry can retain their buying power much more than stocks, your brokerage account or your savings account.

Tip #20: Invest in Tips or Money Market Funds

If you're looking for a relatively safe investment option that will still provide some protection against inflation, consider investing in TIPS (or Treasury Inflation-Protected Securities).

These types of investments are designed to increase in value as the rate of inflation rises, making them a good choice for people who want to safeguard their money without having to worry about it losing its worth over time.

Also, money market funds can outpace inflation as well.

FAQs

What is inflation?

Inflation is a rise in the prices of goods and services over time. It usually occurs when the demand for goods and services exceeds the available supply, increasing prices.

A reason this has happened in recent times is that there is too much cash in the hands of individuals. That cash is causing home prices, gasoline and many other things to rise in price.

What is the current rate of inflation?

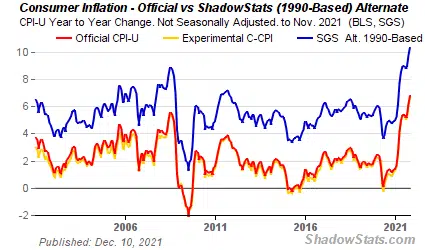

The current rate of inflation, as measured by the Consumer Price Index (CPI), is 6.8% as of November 2021.

Remember, inflation changes every month. So the 6.8% figure above will be different in the coming months and years.

How is inflation calculated?

Inflation is calculated by taking the change in the price of a basket of goods and services over time, dividing it by the change in the price of the same basket of goods and services from a base year, and multiplying by 100.

For example, if the price of a basket of goods rises from $100 to $105 over a period of one year, the inflation rate would be (0.05 / 100) * 100 = 0.005 or 0.50%.

There is also discussion about whether the government is calculating inflation correctly. The government has a vested interest in having American consumers and the general public believe inflation is quite low. In the 1990s the calculation for inflation was changed.

If we are to use the calculator from 1990 inflation is actually a bit over 10%.

And when we use the calculation from the 1980s the number is even higher at nearly 15%.

So, the real question is, which one is correct? I am leaning toward the graphs here and not what the government says.

This is why investing in something other than your savings account is so important. Whether it be commercial real estate, residential real estate, real estate investment trusts (REIT), high dividend-paying stocks or one of the many exchange-traded funds. The simple solution is to be invested, inflation is a killer to your savings.

Keep reading: How To Protect Your Money From Inflation: 15 Tips

What causes inflation (Rising prices)?

Many factors can cause inflation, but the two main ones are demand-pull and cost-push.

Demand-pull inflation occurs when consumers have a higher demand for goods than what is currently available in the market; this causes prices to rise as producers attempt to meet the increased demands of their customers.

Cost-push inflation occurs when there is an increase in costs (such as resource or labor costs) which then gets passed onto consumers through price increases.

What is hyperinflation?

Hyperinflation is a sudden, extreme increase in the price level of goods and services.

Most commonly it is the result of too much money being printed. often as a result of government debt spiraling out of control. This has happened to Zimbabwe and Venezuela most recently. This can happen to any government that continues to print money.

If you think 7% or 15% inflation is bad, how about 500% like the two countries above?

Why is hyperinflation bad?

Many people's savings can be wiped out very quickly leaving them unable to pay for necessities such as food or rent. This is why it’s so important for investors to put their money into investments like an exchange-traded fund.

As investors, we cannot control how much the government prints. What we can control is how we prepare as prudent investors.

What causes hyperinflation?

Hyperinflation is often caused by an increase in the amount of money that's available (like what happens during a government printing more money to pay off debts). This can cause the supply and demand of goods to fluctuate wildly, which leads prices for things like food, gas, rent, etc. to skyrocket out of control- ultimately leaving people unable to afford basic necessities.

This is a worst-case scenario for everyone.

What is quantitative easing?

Quantitative easing occurs when central banks inject large amounts of capital into their economies by buying up assets such as long-term bonds or company shares from private investors on the stock market; this increases liquidity within financial markets.

The United States Federal Reserve has been accused of causing inflation through quantitative easing measures it took after 2008’s Great Recession.

The fact of the matter is that when the government begins to have a hand in the economy things almost always turn out bad for investors.

What are the effects of hyperinflation?

Anyone on a fixed income is unable to buy food as prices increase 50% or more per month. This leaves a lot in a helpless situation.

Even if hyperinflation were to occur the government would deny how bad the situation really is. The Venezuelan government issued a 1 million Bolivar bill due to hyperinflation. But they said it’s because of economic conditions.

Are you seeing the lines in the Matrix yet?

Prudent investors will put their money elsewhere before hyperinflation ravages their savings.

What is the difference between inflation and hyperinflation?

Inflation is tolerable when low enough, hyperinflation leads to collapse to everyone besides the top 0.00001% of society.

How I make $11,000 per year renting out my spare rooms?

Get access to my FREE guide now.