Financial Literacy is an important subject in today's era, but knowing how to utilize it is far more important for achieving financial independence. Teenagers & youth must understand the significance of it & gain an understanding of it so they can manage their money efficiently, pay off student loans, and invest wisely. So, to be aware of it, here are the Top 10 financial literacy programs & resources that everyone should know about:

1. Books

People lack awareness about financial literacy because they are barely taught it at home or school. It is often neglected as it's not a significant subject or a taboo. The knowledge you've is what you've inherited from your parents these years. So, to become financially literate, read and explore books, e.g., Think & Grow Rich, Rich Dad Poor Dad, and Your Money or Your Life.

2. Government Resources

Government websites often contain blogs & articles regarding finance & loan schemes for educational purposes. They are published to financially educate people on how to manage debts, increase employment opportunities & contribute to raising GDP (Gross Domestic Product) per capita. These resources prove helpful in creating awareness & moving towards a prosperous future.

3. Methods & Techniques

The 50-30-20 is a famous financial management rule that suggests splitting your income into three streams: Spending 50% of income on needs, 30% on Wants, and 20% on savings for future emergencies. This rule motivates people to practice better money movement and reduce mental stress.

4. Online Courses

Some platforms offer online courses to liberate financial literacy & independence. It includes platforms like Coursera, Edx, Udemy & Grad.ly, etc. Instructors from the world's top universities, such as Harvard, MIT, Wharton Business School & University of California, teach students. They prepare students to tackle the future's financial hardships in competing emerging economies.

5. Financial Counselors

Financial counselors educate people to manage their money, invest in markets with high ROI (return on investment) & smartly manage their debt, such as student loans, etc. They play a crucial role in spreading awareness of financial literacy among youth.

6. Online Forums

Join online communities & popular forums of like-minded people to stay aware of market trends & insights. You can join Facebook groups and subreddits based on financial topics. These forums are created to connect with market analysis & trends, educate beginners, and seek guidance from professionals in the field.

7. Website Newsletters

Websites like Investopedia & The Balance publish content related to financial topics. They break down complex economic subjects & explain them in depth, which is quick to understand. People can sign up by e-mail to subscribe to the free newsletters that educate them with new financial terms daily.

8. YouTube Channels

There are YouTube creators that create content centric towards financial literacy. It includes creators like Iman Gadhzi, Alex Hormozi, Neil Patel & Ishaan Arora, etc., with large fan base audiences vouch for their content online. They help educate youth on understanding financial literacy so they can manage their expenses, pay off student loans, and invest in potentially profitable assets.

9. Financial Apps

Apps like Pocket Guard, YNAB & Personal Capital, etc., have recently gained a spotlight due to their approach to helping people manage their expenses. Pocket Guard app is designed to cut off overspending habits; it restricts users with daily spending limits. YNAB (You Need a Budget) & Personal Capital apps help stay within budget, track portfolios & advise investment strategies.

10. Startup Success Stories

People should listen to Startups' success stories to dwell on financial literacy from the market leaders. Understand any startup's idea, market research, challenges, and USP. For example, Warren Buffett is a prime example of financial literacy's success. He used to sell magazines door to door, meeting different types of people every day. He was good at accounting & being financially literate. He started investing at the age of 11 whom people today know as Berkshire Hathaway's CEO.

“She Supports Donald Trump?” 10 Surprising Stars Who Support The Former President

There are many stars who support the former president that will surprise you.

Ready to make your first budget?

Enter your email and get the free template

These 10 Celebrity “Real” Names Are Very Different Than Their “Stage” Names

Many celebrities take on stage names to either protect their identity, or to reinvent themselves into someone else. Here are 10 celebrities' stage names vs. their real names.

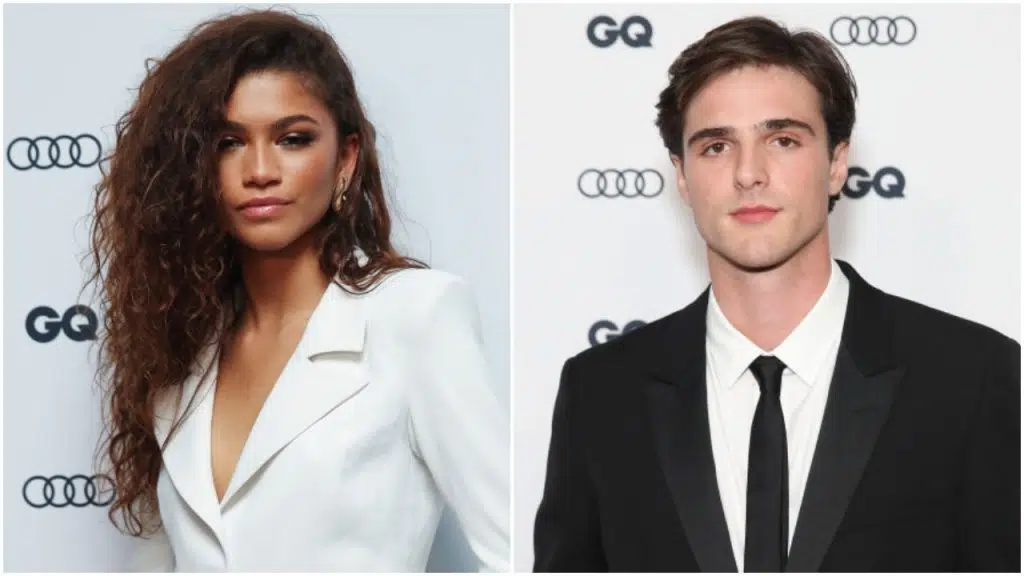

“I Hate Them Together” These 10 Surprising Celebrity Couples Made Fans Furious

Everyone has their preferences as to who their favorite celebs should have a happily ever after with. And, understandably, fans can become upset when those happily ever after dreams are crushed. Here is a list of celebrity couples that fans absolutely did not approve of.

10 Canceled TV Shows People Want To Come Back

How I make $11,000 per year renting out my spare rooms?

Get access to my FREE guide now.